Search This Blog

Understanding Israeli life, culture, community, climate & people's habits

Posts

Showing posts with the label Start-Ups

Posted by

Ami Vider

Entrepreneur at an Alenbi Street Bar

- Get link

- Other Apps

Posted by

Ami Vider

Ramat Gan Bursa vying for Tel Aviv's FinTechies

- Get link

- Other Apps

Posted by

Ami Vider

Givatay'im Library Garden & FinTech Exits

- Get link

- Other Apps

Posted by

Ami Vider

Start-up Attraction: ScaleIO and Alvarion: Two Different Tech Exits

- Get link

- Other Apps

Posted by

Ami Vider

Two Start-Ups, Different Fortunes (Money and Passion)

- Get link

- Other Apps

Posted by

Ami Vider

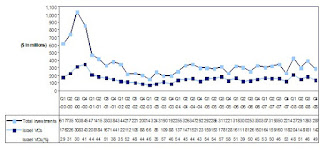

Israeli Economic Shift: Less Start-Ups, Bigger Investments (Globes™ top 10)

- Get link

- Other Apps

Posted by

Ami Vider

Israel Start-Ups Need Change Again

- Get link

- Other Apps

Posted by

Ami Vider

Northern Israel Entrepreneurs Active and Working - Technion Conference

- Get link

- Other Apps

Posted by

Ami Vider

Can Israeli Technologists Make THE Peace with Palestinians? (A Ghost Story)

- Get link

- Other Apps

Posted by

Ami Vider

Start-Up Nation: Book on Israel's Entrepreneurship

- Get link

- Other Apps

Posted by

Ami Vider

Israeli Tech On Hold: VCS, Exits & Eggs

- Get link

- Other Apps

Posted by

Ami Vider

Israeli Venture Capital Report - Start-Ups Still Starting

- Get link

- Other Apps